Allies in

Investment

We work collaboratively with both investors and advisors to bridge the worlds of finance and impact.

Allies in

Investment

We work collaboratively with both investors and advisors to bridge the worlds of finance and impact.

How we work with investors

and advisors:

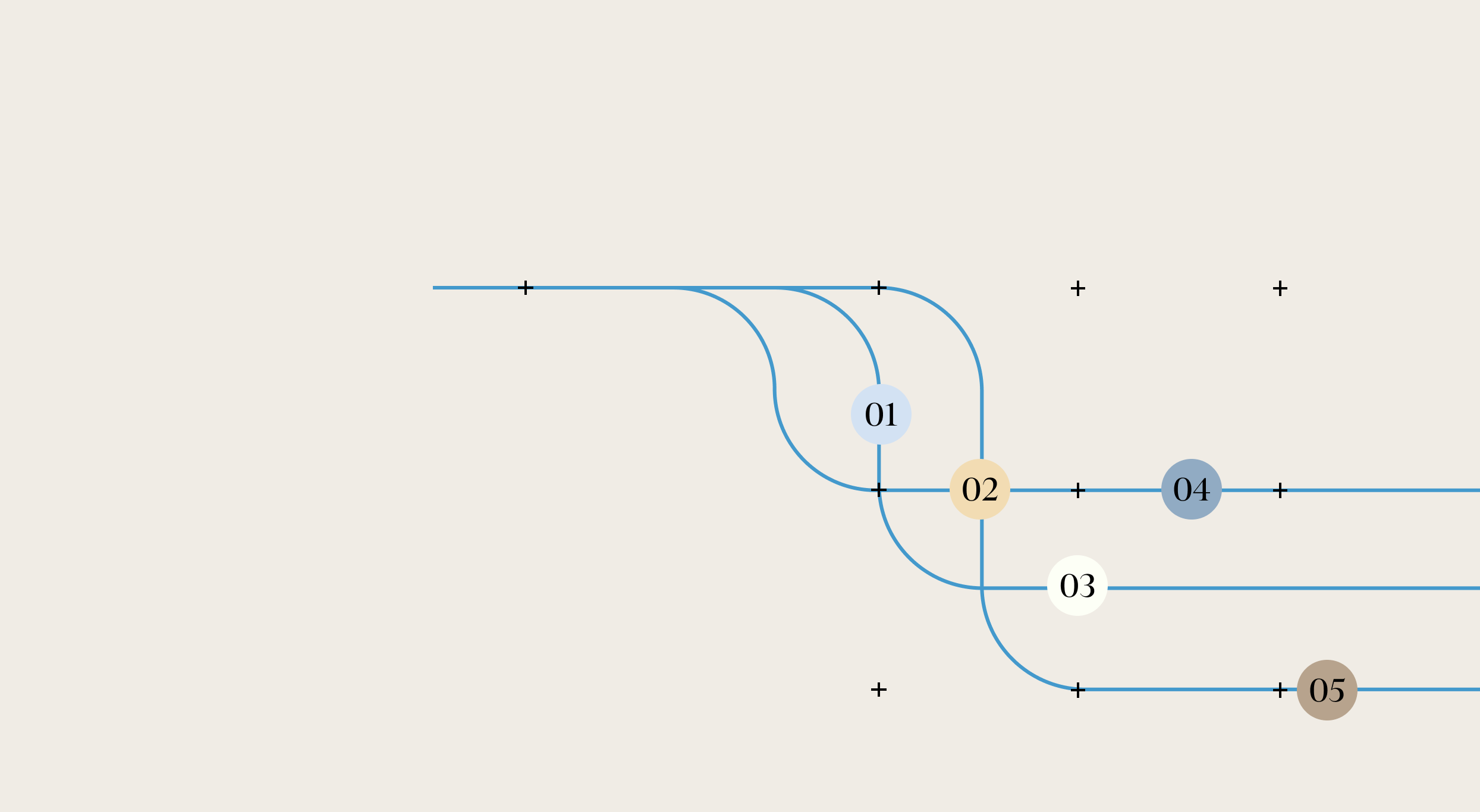

01

Bespoke

Strategies

We co-create approaches for individuals and stakeholder groups by:

+ Defining and mapping your core motivations and impact goals, across public and private markets and philanthropy

+ Providing context on the issues you care about alongside potential solutions

+ Offering tangible steps for supporting your legacy

02

Broad

Access

We connect you with vetted, best-in-class, third-party managers and investment products including:

+ Individualized private market solutions

+ Lowered minimums and favorable terms

+ Custom diligence services for your unique goals

03

Research &

Education

We keep you informed with in-depth offerings like:

+ Rigorous analysis and impact assessment

+ Deep dives into over 20 areas of interest

+ Training and educational support on the latest trends in impact investing

04

Tailored

Modalities

We know flexibility is important as we work together to accomplish your goals, which is why:

+ For individual investors, our long term relationships begin with strategies that are typically created over 4-8 months and anchored by four in-person meetings, leading to lasting, implementation-oriented relationships

+ For advisory firms, we engage at the firm level to clarify your goals and define how we work together to accomplish them

+ For everyone we work with, we calibrate timelines and meeting structures that reflect your unique needs

05

Joining

Strengths

We work directly with existing advisors (from tax, accounting, and legal, to financial, estate, and insurance), taking every aspect of your financial picture into consideration to uncover and deliver on the most efficient strategies for you, in our work together.